Image

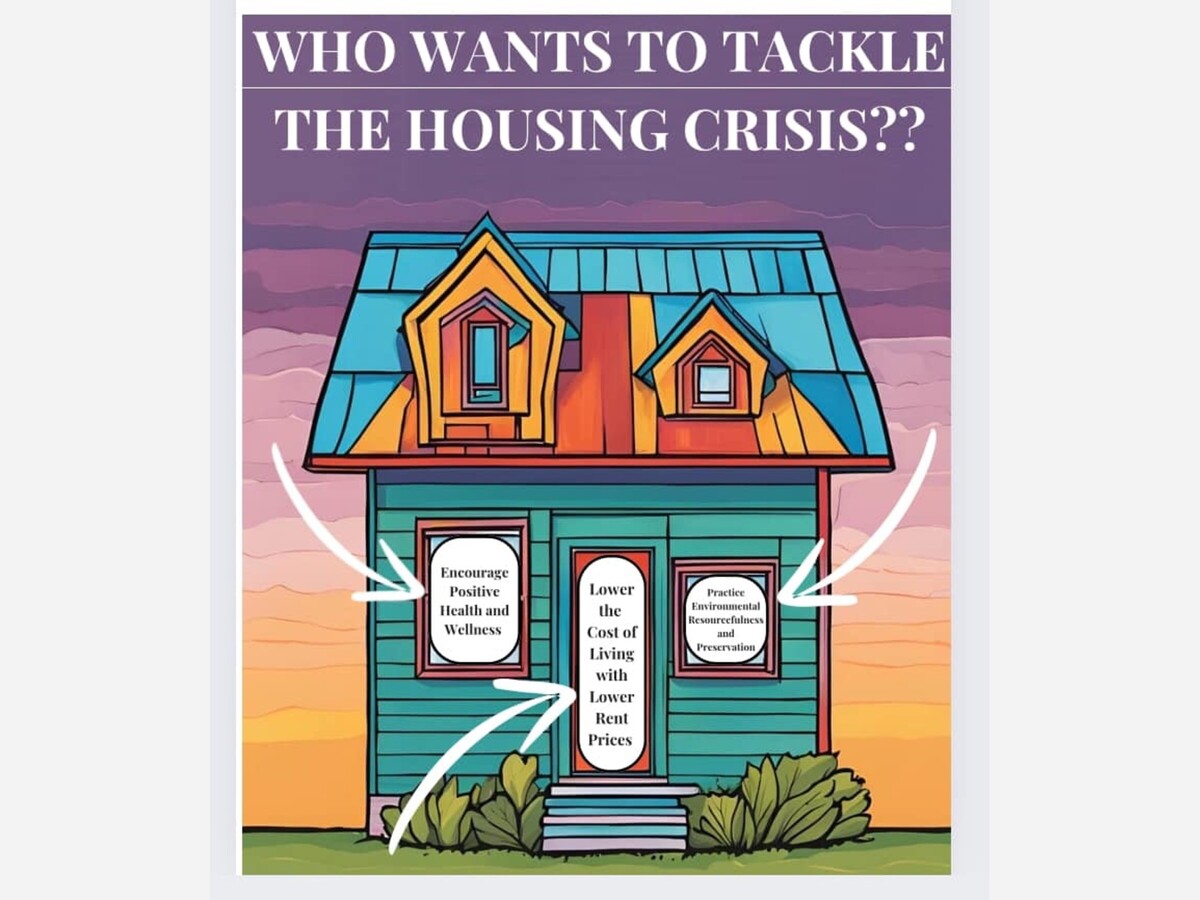

LEBANON, OH -- Husband and wife team Andy and Carrie Huber of Lebanon have been busy working on a new and unique concept to help fix the housing crisis ... at least in the Lebanon area.

"Our aim is to establish the very first and very best tiny home residential rental community in Ohio by channeling our personal and professional strengths into a peaceful and pleasant rental neighborhood that operates similarly to an apartment complex, but is more visually and functionally similar to a single-family home neighborhood to fulfill the need for more middle housing in the marketplace," Carrie explained.

Carried added, by focusing on the long-term cost-effectiveness of various neighborhood elements, the cost of rent would be a modest car payment. Carried said that they want the rental rates to be below what a an average apartment equivalent would be and would include a centralized outdoor free space.

"We want to provide community elements that focus on respect and care for its residents and the environment," she said noting that people are hurting financially because of the cost of housing.

To illustrate how the median household income in Ohio falls below the national average and how the gap between income and housing costs continues to widen, let's examine the relevant data and trends.

Median Household Income Comparison

This shows a significant gap where Ohio's median household income is approximately $7,060 less than the national median. This income gap has implications for Ohioans' ability to afford housing, especially as housing prices continue to rise nationally and in the state.

Housing Costs and Income Disparity

Cost Burden and Housing Affordability

The concept of "cost burden" helps to further illustrate the widening gap between income and housing costs:

This gap between Ohio’s median household income and the national average, combined with rising housing costs, highlights the economic challenges many Ohioans face. As this gap continues to widen, the need for affordable housing solutions and income growth initiatives becomes increasingly urgent to ensure all residents can access safe and affordable housing.

This is where Carrie and Andy Huber's company Humble Habitats, LLC comes into play. A tiny home residential rental community, with the cost of rent being around a modest car payment below what its apartment equivalent would be. This would allow people to pay off debt or save to purchase a home.

The Hubers can be reached by calling 513.968.9465 or email HumbleHabitats@outlook.com or visit Humble Habitats LLC FB page to learn more.