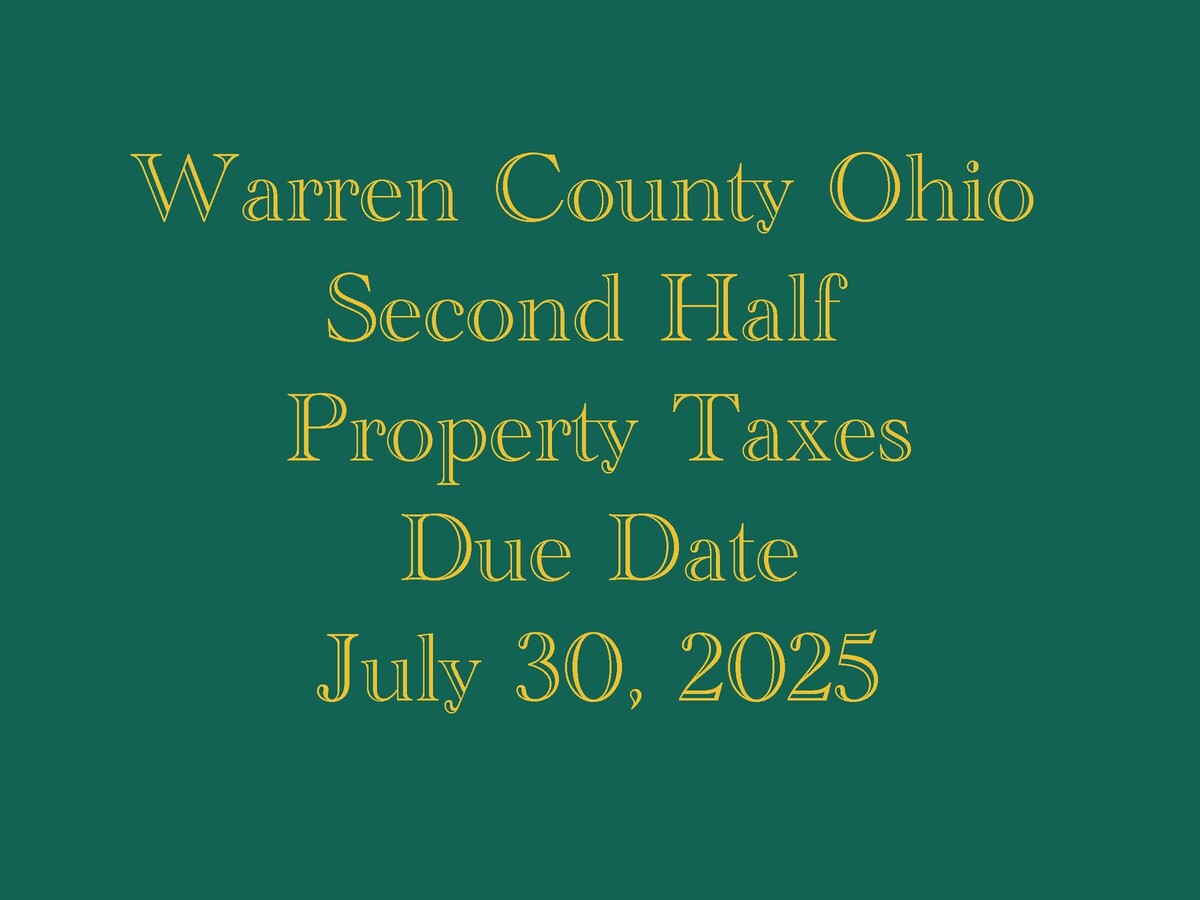

Image

WARREN COUNTY, OH -- The due date for the Second Half of Warren County Ohio Property Tax is quickly approaching for the 2024 tax year, which is payable in 2025. Warren County Treasurer Barney Wright has noted on the district website that the property tax due date for the Second Half is Wednesday, July 30, 2025.

For Beth Blackmarr of CitizensforPropertyTaxReform.org, these Second Half Property Tax due dates, affecting all 88 counties in the state, will help CitizensforPropertyTaxReform.org collect the needed signatures to place an amendment on the November Ballot that would change the Ohio Constitution by eliminating property taxes. For the proposed amendment to be on the ballot, the group needs to gather signatures from at least 5% of voters in 44 counties, as well as a total number of signatures equivalent to 10% of the last gubernatorial election's turnout.

Joy Broedling of Warren County noted that she will be collecting signatures, along with some others, at the Warren County Fair happening this week (July 14 through 19) at the fair grounds in Lebanon.

"We will be collecting signatures at the GOP booth," she said, adding that the Warren County Republican Party has been allowing her to use their different functions to collect signatures.

"This is NOT a republican or a democratic issue. It is an Ohio issue. Anybody who owns property, or even rents... these continued increases in property taxes affects us all," Blackmarr said.

Warren County's Auditor Matt Nolan explains the increase of property taxes on the Warren County Auditor Website

Click on image above to go to Warren County Auditor Website

Click on image above to go to Warren County Auditor WebsiteFor further information or assistance contact the Warren County Treasurer's Office at (513) 695-1300.