Image

LEBANON, OH -- Ohio State Rep Adam Mathews of District 56 shares why many in the Ohio State House of Representatives are wanting to pass a bill that would eliminate the State Income Tax and the Commercial Activity Tax... along with "right sizing government."

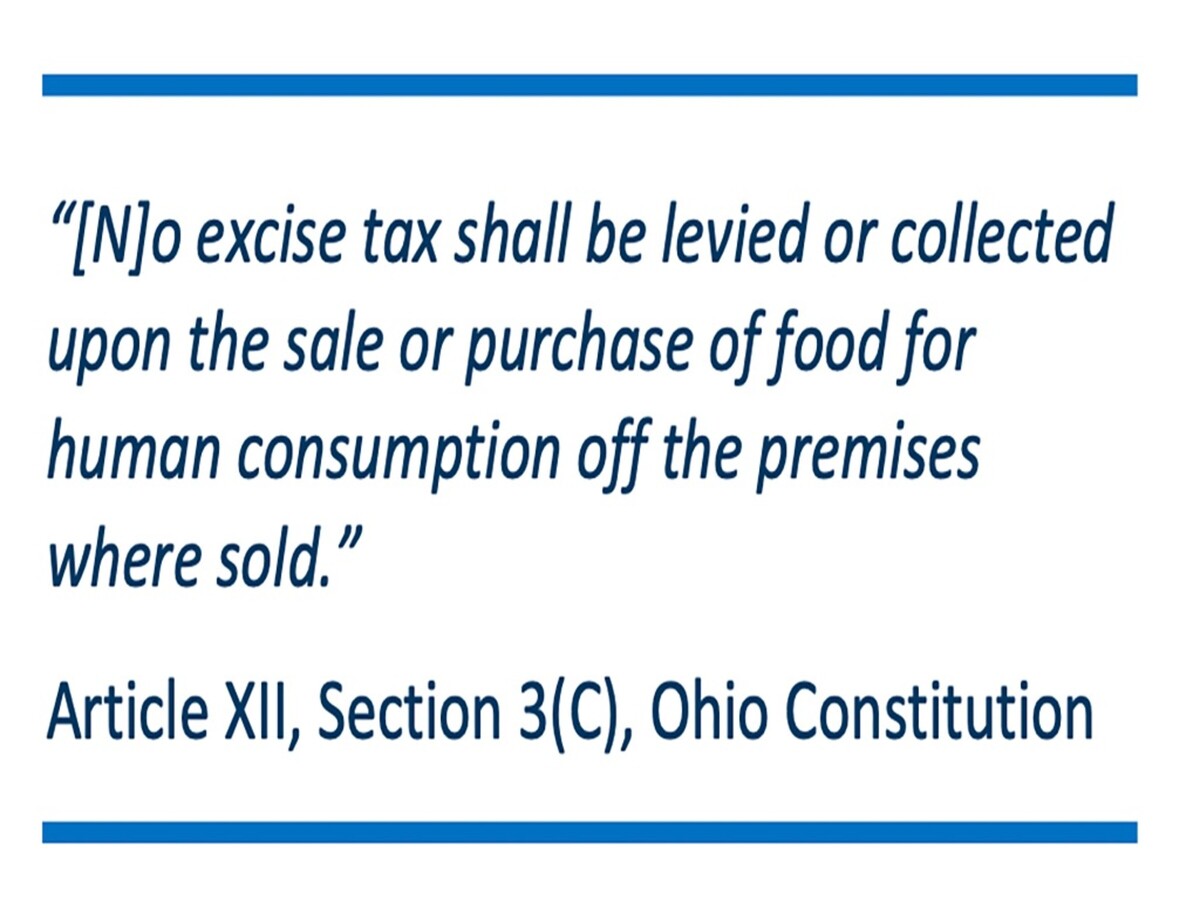

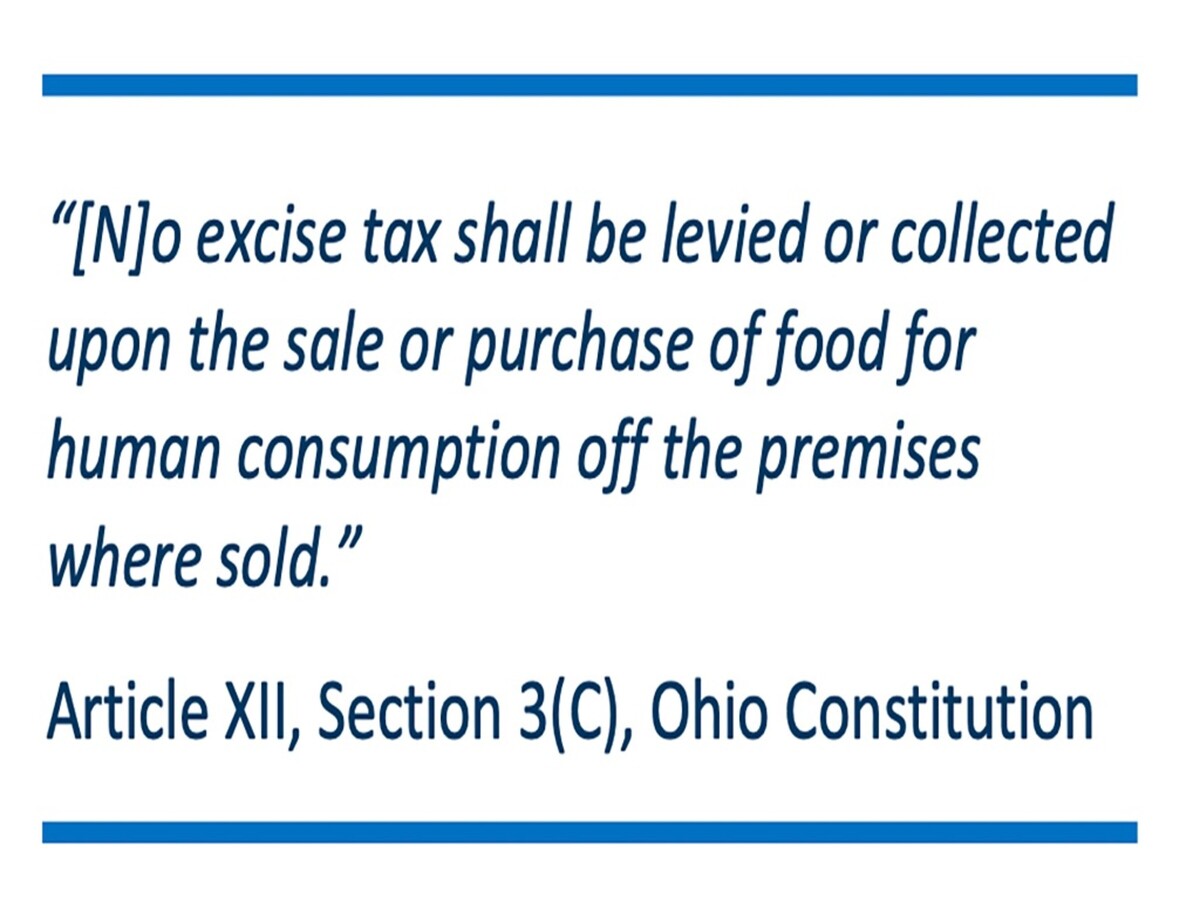

In this interview, he shares where and how the state is planning to recoup the monies lost if this tax is eliminated. He also addresses the rumor that they, the Ohio House and Senate, plan on recouping it by taxing food or other essentials, such as baby diapers.

Mathews shares that he, along with other elected persons, have been holding town hall meetings showing how eliminating these taxes are good for Ohioans and he explains that the state is not and cannot add taxes to basic items such as food, rent, diapers and baby formula.

"Ohio's Constitution doesn't even allow that," Mathews said.

Mathews, also, shares how the Commercial Activity Tax is a hinderance in brining new and keeping businesses to Ohio. Eliminating this tax would be better for economic growth for the state he noted.