Image

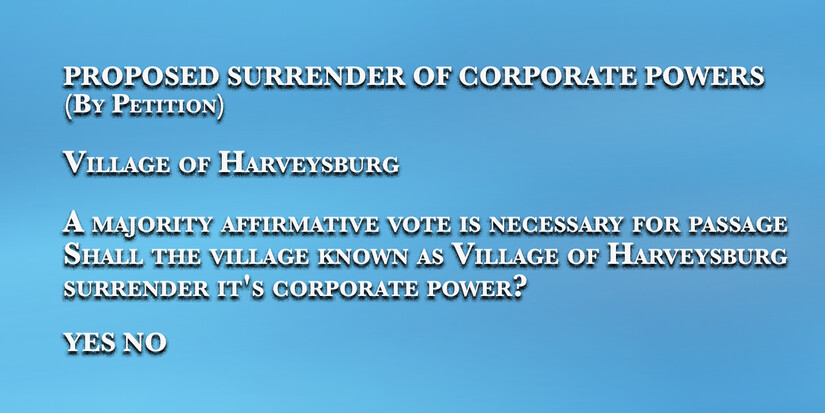

HARVEYSBURG, OH -- Harveysburg voters have a major descion to make in this year’s election — to keep or dissolve their village. On the November 7, 2023 ballot is this question…

By petition means that 30% of the Harveysburg electors signed a petition requesting that this issue be placed on the ballot, allowing the electors to decided if they want the village to be dissolved or not.

While it takes 30% of the electors to sign a petition to get the question on the ballot, it will still take a majority "yes" vote for the village to surrender its corporate powers. If the village surrenders its corporation, the village's real and personal property will be transferred to Massie Township, where the village is located, according to the Ohio Revised Code 703.201(C).

"The Auditor of State is required to assist a village that surrenders its corporate powers by petition of the electors," states lsc.ohio.gov.

Also according to lsc.ohio.gov it is the village's responsibility to provide the notification to the Auditor of the State. "The village has 30 days to provide the notification and the Auditor of State has 30 days to commence the audit." And, while the village is prohibited from creating new liabilities, it can continue to collect taxes to pay its existing obligations.

If the majority of the votes cast are "no" votes, the village will stay incorporated and the other issues being asked on the ballot will apply if passed.

Two issues Harveysburg voter are being asked:

Also on the ballot for Harveysburg residents, who are registered to vote, are candidate issues:

HARVEYSBURG

RUNNING FOR MAYOR:

RUNNING FOR COUNCIL (Pick 2)

MASSIE TOWNSHIP

Fiscal officer (Choose 1)

Trustee (Choose 1)

CLINTON MASSIE SCHOOL BOARD (Pick 2)