Image

LEBANON, OH -- Tax Season is upon us. Not only is it time to begin to file our state, federal and local taxes, it's also time to pay our Property Taxes. For many homeowners still paying on their home, the property taxes are taken out of their escrow. But for others in Warren County, a tax bill should have been received. According to the Warren County Treasurer's Website, residents were mailed tax bills in January and the 1st half of the 2023 real estate taxes are due on Wednesday, February 28,2024.

When it comes to appraisals, property taxes and levies, does anybody really understand how it all work?

After doing some reading and research, I did find that Finney Law Firm and H&R Block have both posted well written articles on their websites that explain how property taxes work. And, the Ohio Department of Taxation did a video, which is linked below, explaining property taxes and how or if reappraisal's will affect property taxes.

According to H&R Block, Ohio property tax was Constituted in 1825 and is the oldest type of tax in the state. And, it is the assessed value of the property that the county auditor will use to generate each property owner's tax bill, not the appraised market value.

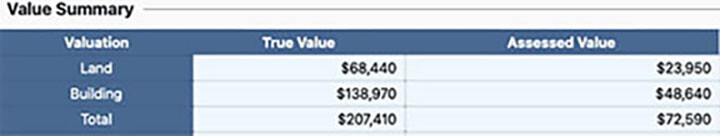

It is 35% of the property’s appraised market value. To find a Warren County Ohio property's assessed value visit the Warren County Property Search page. You can find a property several ways. Searches can be done by inputting a Name (Last), Address (Street Name), Parcel ID, Account Number, or subdivision or Lot.

Once the property is found, click on Summary.There, the True Value and Assessed Value will be found. It is the Total Assessed Value that is used to figure out the property tax for that piece of property.

The Assessed Value is 35% of the Appraised True Market Value

The Assessed Value is 35% of the Appraised True Market ValueEvery six years, through a reappraisal process, every property in the county is inspected and appraised for its fair market value with an appraised value being set. This practice is known as a Sexennial Reappraisal, with an update being required every third year, known as the Triennial Update. Both state constitution and state statue require this to be done. This job falls on the county auditor, which in Warren County is Matt Nolan.

Unlike many of its neighboring counties whose residents maybe seeing higher property tax bills this year due to a Triennian Update last year, most residents in Warren County will only see a change in their tax bill if a new levy was passed in one of the taxing districts it sits in, such as school levy or fire levy.

According to the tax.ohio.gov Sexennial Reappraisal and Triennial Update calendar, Warren County property owners will be having their properties reappraised this year (2024), with the Triennial Update being scheduled for 2027.

Warren County property owners could see an increase in property tax bills next year. But first, the 2024 appraisals will need to be turned into the State, and then, the State will need to approve the appraisals to be sure they meet the fair market value.

Property owners "inside milage" will increase if property values increase. For example if a home is appraised at $100,000, the assed value would be $35,000. If 1 mill is calculated to be 1/1000 of a dollar, then 1 mill equals $35. Thus, if the same house is appraised at $125,000, the assed value would be $43,750, with 1 mill now increasing in value to equal $43.75.

In Ohio there is a "ten-mill limitation," meaning the combining amount of taxes that may be levied on any taxable property shall not exceed ten mills on each dollar of tax valuation unless voters approve for more taxation. Taxing authorities such as schools, libraries, and cities can ask voters living within its taxing authority to pass a levy once the "ten-mill limitation" is met.

"The majority of taxes were proposed by taxing authorities and approved by the voters in that taxing district," explains Andrew Winkel, Real Property Division in Ohio Department of Taxation in the linked video above.

"About 90% of your tax bill is outside millage, which is a result of tax levies that year after year generate a fixed amount of revenue for the levy recipients (depending on the district, schools are about 55-70% of your tax bill)," wrote Christopher P Finney in his May 23, 2023 Blog on finneylawfirm.com.

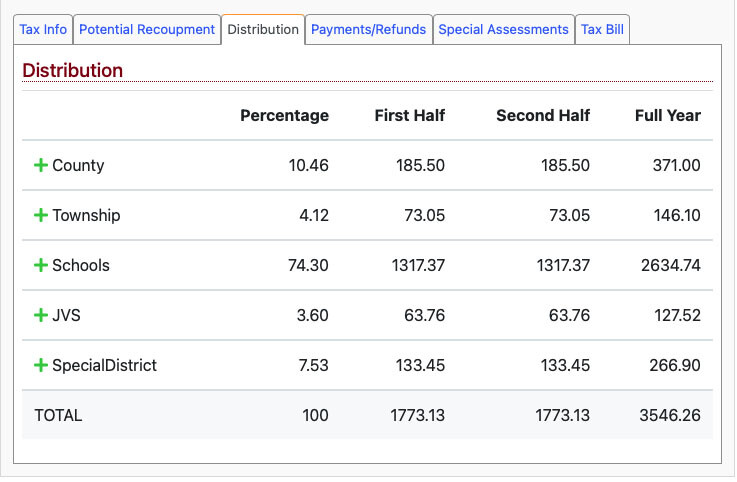

Property owners can see the breakdown on where the property tax dollars are going on the auditors website. Once on the site of the property being reviewed, go to the "Tax Bill," then click the "Distribution Tab." It gives a breakdown on where the dollars are going.

Once on the site when clicking on the green+ signs, the page opens up more, giving even a further breakdown on where tax dollars are going.

Once on the site when clicking on the green+ signs, the page opens up more, giving even a further breakdown on where tax dollars are going. In the above photo, it shows that almost 75 percent of this property's owner property tax is going to the local school district. If you are a property owner in Warren County and want to know where your property taxes are going, visit the auditor's site. You might be surprised to see where your tax dollars are going.